Solent Investment Strategies

Aims consistently to mitigate risk in financial markets across a range of conditions using a disciplined, researched scientific approach.

WORK WITH SOLENT

ABOUT US

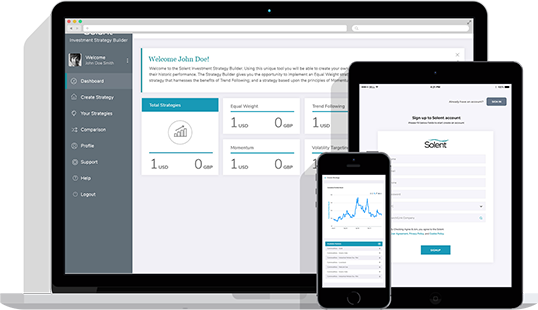

Solent is a is a cloud based financial software company, bringing you an investment platform that helps you make data-driven investment decisions and assists with reaching your long-term investment objectives. Solent brings together data science, technology and academic research.

investment strategy

Transforming investment management

Solent replaces traditional asset management, which is based on informed guesses about the future performance of financial markets, with asystematic formulaic approach, based on rigorous academic research.

ISB LOGIN

Roderick Collins

Co-founder

“Solent’s investment solutions build on the latest, cutting edge academic research. The implementation of these solutions is then further refined to enable us to address the investment needs and goals of a wide range of clients.”

Solent is about providing a successful investment experience

That means more than just mitigating risk. It means offering peace of mind because investors know that a transparent approach backed by decades of research is powering every decision. The goal of Solent is to help industry professionals and institutions be prepared, so they can plan with confidence.

ACADEMIC RESEARCH

Solent has been partnering with professors and reputed academics over several decades which has led us to publish significant data-science based research.

Perfect Withdrawal in a Noisy World: Investing Lessons with and without Annuities while in Drawdown between 2000 and 2019

Download Paper

Download Paper

Trend following value vs growth: size matters: tail risk, momentum, and trend following in international equity portfolios

Download Paper

Download Paper

The trend is our friend: risk parity, momentum and trend following in global asset allocation

Download Paper

Download Paper

CONTACT US

Message us to request a demo and receive other information: